Alumina: Mystery of High Profits Amid Overcapacity

Recently, commodity prices have been falling, with several varieties standing out, one of which is alumina, which has shown strong performance recently. Going against the trend is always worth paying attention to.

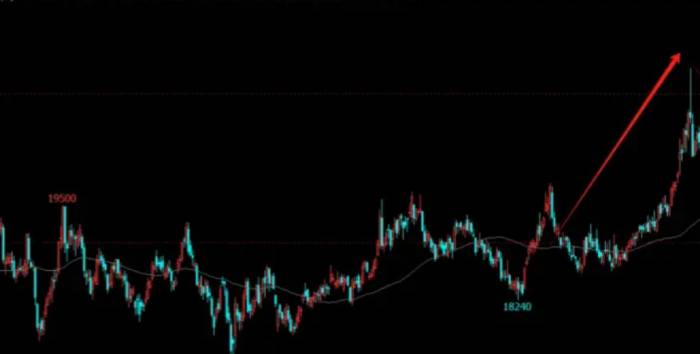

Starting from December last year, after experiencing three rounds of increases, the price trend of alumina remains very strong at present. (The current profit is extremely considerable, exceeding 1000 yuan/ton).

However, downstream of alumina, aluminum metal, apart from a rebound in February this year following the general trend, has now returned to the starting point.

This is quite awkward. Approximately 95% of the world's alumina production capacity is used for the electrolytic smelting of aluminum, and under such concentrated demand, the price trend of alumina as a raw material has seriously diverged from that of downstream aluminum metal.

Looking back at the rise of alumina in the past few years, the first round of increases originated from the coup in Guinea. In 2021, after Mamadou Diallo led the military to launch a coup and established a transitional government, alumina welcomed the first significant increase. (Guinea is the world's second-largest producer of bauxite, the raw material for producing aluminum metal, supplying about 25% of the world's bauxite. China's alumina production capacity accounts for a higher proportion, and the dependence on imported bauxite is high. The import share increased from 35% in January 2017 to 73% in April 2024.)

However, after the political situation stabilized relatively, prices began to fall. Nevertheless, in December last year, Guinea encountered problems again. On December 18, 2023, a violent explosion occurred at a fuel storage facility in Conakry, the capital of Guinea.

This incident had a certain impact on the transportation of bauxite in the area, leading to the suspension of some mines. In addition, Guinea's trade union movement also proposed an indefinite nationwide strike starting from February 26, 2024, causing further disruption to the production and export of bauxite.

In March 2024, two alumina plants of Rio Tinto Group located in Australia, Yarwun Alumina Refinery and Queensland Alumina Limited, were affected by a natural gas pipeline fire, resulting in a reduction of operating capacity by about 1.2 million tons/year.

On the early morning of May 21, Rio Tinto Group announced force majeure for the shipment of alumina from the Yarwun smelter in Australia and Queensland Alumina Limited, citing a shortage of natural gas inventory/supply for power generation. Previously, the capacity recovery time for the two alumina companies was in June, but affected by local natural gas supply, it is expected to be postponed to September. In addition, Alcoa closed its Kwinana alumina plant in Australia in April, involving an operating capacity of about 1.8 million tons/year.Therefore, the export profit of alumina opened in June and reversed the trade flow of alumina after that, turning China from a net importer of alumina in February-April to a net exporter in June-July.

Domestic mining has also encountered problems. Main bauxite producing areas such as Henan and Shanxi have been affected by environmental safety inspections and other factors, leading to large-scale shutdowns and a decline in ore grade. As of July, the cumulative output of bauxite in China was 32.8067 million tons, a year-on-year decrease of 17.43%, with overall production remaining at a low level.

At the same time, the demand for domestic aluminum electrolysis has been relatively strong this year. From January to August 2024, China's aluminum electrolysis output was 28.91 million tons, with a cumulative year-on-year increase of 5.1%.

Although affected by the downturn in the real estate industry, the output of building profiles in 2024 may decline, the aluminum consumption of the new energy industry chain has been rapidly increasing. Among them, the aluminum profile consumption of photovoltaic frames, energy storage battery packs, battery trays, bumper beams and other finished products is relatively high, driving the increase in the output of related industrial profiles, thus compensating for the decline in the output of building profiles. It is expected that the domestic industrial aluminum profile output in 2024 will increase by 6.9% year-on-year to 11.49 million tons.

Therefore, at present, the pattern of alumina is very clear, with weak supply and strong demand, and the inventory has obviously declined, and the bullish trend is very strong.

However, as the saying goes, high profits will turn all bulls into bears. In the long run, the fundamentals of alumina are relatively loose.

Although the supply of domestic alumina is still weak, in the short term, in addition to the 500,000 tons of capacity of Inner Mongolia Zhixuan to be increased, the latest new supply will have to wait until the 2 million tons of the second phase of the Fangchenggang Huasheng project in mid-November. But the release of overseas capacity will become the key to determining the alumina capacity.

With the projects represented by companies such as Tianshan Aluminum Industry, Dynamic Mining, and AMC being put into production and reaching production capacity, the bauxite output in Guinea in 2024 is expected to increase by 24.4 million tons to 142.63 million tons.

In the long term, the production of Kaibo Energy and Sulex projects at the end of 2024 is clear, the construction of the second and third phases of CBG, the production of TBEA bauxite project, and the increase in SMB output are expected to further contribute to the increase. Minsheng Securities estimates the bauxite output in Guinea for 2024-2026 to be 143/167/196 million tons.

Therefore, the current variables of alumina pattern are either on the demand side or on the supply side.On the supply side, as I mentioned earlier, the production capacity of Guinea, coupled with domestic capacity, is gradually being released. Overall, the future capacity of bauxite is trending towards relaxation, with the key being demand.

On the demand side, things appear to be relatively good since the production of aluminum this year is still showing positive growth. However, the persistent inability of Shanghai aluminum prices to rise has already indicated the underlying issue.

In the future, there will be two significant issues on the demand front:

1. Recession Expectations: Although the United States has been talking about a soft landing, achieving one is not easy. The coming months will be when high interest rates take effect, and the pace of economic downturn may exceed market expectations.

2. Exports: Since the beginning of this year, the rapid growth in aluminum product exports has completely compensated for the insufficient consumption in traditional sectors. However, the drag on primary aluminum demand from the real estate sector is ongoing, and the export situation is being influenced by policies in various countries. Whether exports can continue to sustain and maintain such strong growth is a significant question.

Summary:

The continuous surge in alumina prices this year has mainly been affected by the constraints on both domestic and international production capacities, including strikes in Guinea and the shutdown of alumina plants in Australia. However, the most fundamental reason is the large-scale suspension of domestic bauxite production due to environmental protection and other factors, leading to a contraction of capacity by about 17%.

At the same time, the demand for aluminum in China has been influenced by the gradual replacement of traditional demand by new demand from new energy sources, and overall, it still maintains a relatively high capacity utilization rate. In the first eight months, the production capacity of electrolytic aluminum still increased by 5.1%.

Currently, the entire alumina industry is in a phase of very high profits, but the market's expectation for its production capacity is severely excessive. Domestic alumina production capacity exceeds 100 million tons, while the output is only slightly over 80 million tons, making it an industry with absolute overcapacity. The critical issue is that the production capacity of electrolytic aluminum has already hit the ceiling, but the capacity of alumina is still being increased.Looking ahead, the issue of insufficient production capacity is gradually being alleviated step by step. On the demand side, there is a concern about its sustainability. However, with production capacity not yet fully realized, the upcoming National Day and the restocking before the Spring Festival are both likely to rekindle the enthusiasm of the bulls. At the same time, due to high profits, domestic alumina continues to operate at full capacity and even overcapacity, and the risk of supply reduction due to subsequent alumina maintenance inspections is also not low.

This variety reminds me of soda ash, and they share a common characteristic, which is that the supply is highly concentrated. Once there is a reversal on the supply side, it is easy to have a trend-following market, which is worth paying attention to. At this position, either wait for a high position to go short, or do some arbitrage, short alumina and long Shanghai aluminum.